Getting a grip on your finances starts with setting clear goals. You’ll want to figure out both your short-term and long-term aims. Short-term might be saving for a new gadget or a weekend getaway, while long-term could be planning for that dream house or retirement. Knowing what you’re aiming for gives you direction and motivation.

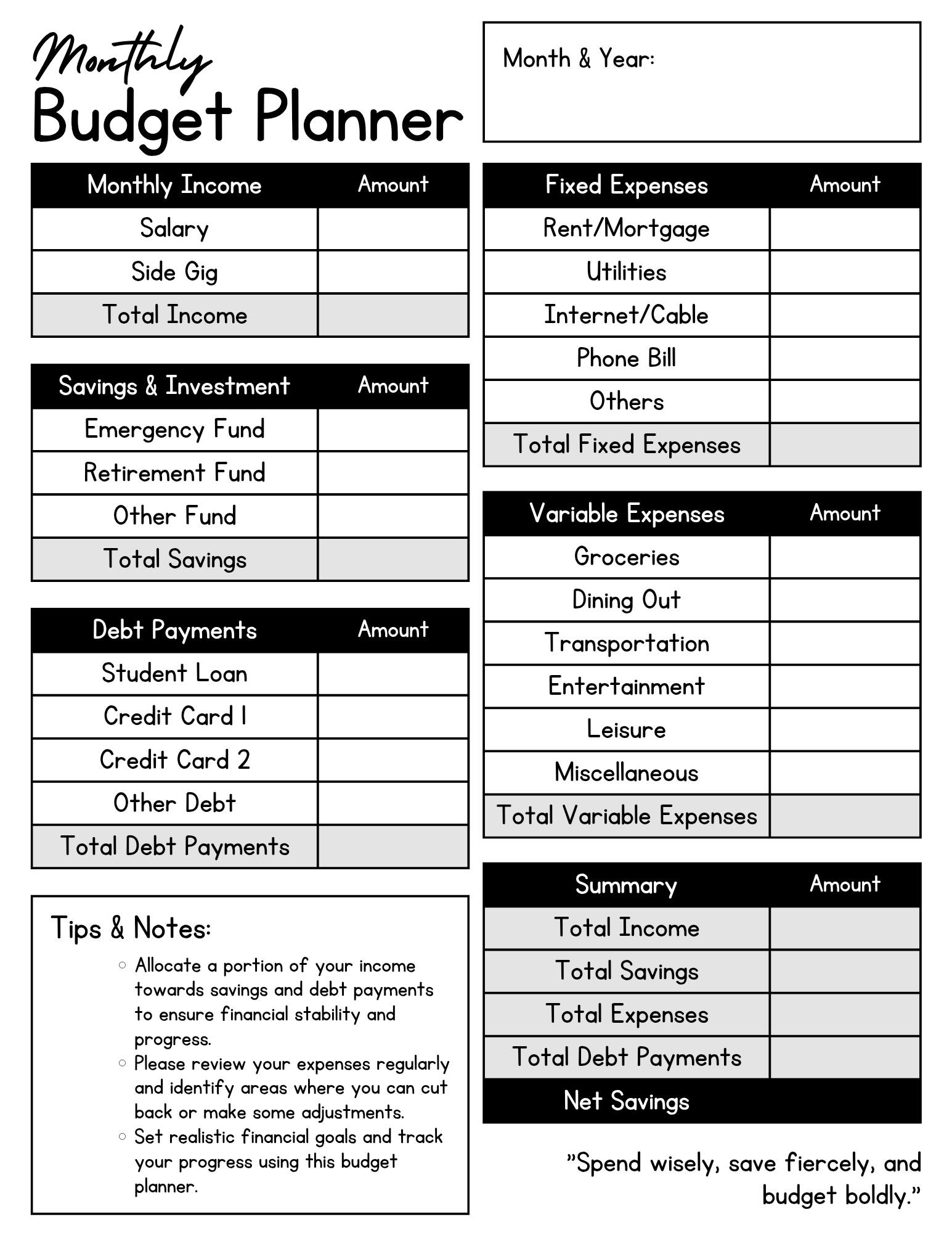

Breaking down your monthly expenses comes next. Recognize the difference between fixed and variable costs. Fixed expenses, like rent and insurance, stay the same each month. Variable costs include things like dining out and entertainment, which can fluctuate. Pinning these down helps you see where your money’s going and what you might be able to trim back.

Let’s talk income. What’s coming in and how regularly? Some folks have a steady paycheck, while others might have income that’s less predictable, like freelancers or gig workers. Knowing your exact monthly income helps you avoid the trap of spending money you don’t really have.

Debt’s a big word in budgeting. You need to know what debts you have, the interest rates attached, and how they play into your overall financial picture. Not all debt is bad, but you’ve got to manage it thoughtfully. Knowing these details can help guide your budgeting priorities.

Creating a Tailored Budget Strategy

Choosing the right budget method is like finding the perfect pair of jeans – it needs to fit you just right. The Envelope System is great for those who love cash management, while the 50/30/20 rule simplifies saving and spending into neat categories. Zero-based budgeting is about allocating every dollar you earn to a specific purpose. It’s all about what works best for your lifestyle.

Spending limits should be more than just numbers on a page. They need to reflect your reality and the things you enjoy. Balancing between your wants and needs requires honest reflection on your spending habits. It’s totally okay to budget for fun stuff; just make sure it doesn’t overshadow essential bills.

Growing that savings pot is key. Whether it’s building a stash for emergencies or putting away for future investments, setting aside a portion of your income is non-negotiable. Even if it’s just a small percentage at first, the habit is what counts.

Budgeting tools and apps are lifesavers in the digital age. They can make managing your finances a breeze, tracking your spending without the hassle of paper and pens. Explore until you find the one that clicks with how you think and interact with your money.

Tracking and Adjusting Your Budget

Regularly reviewing your budget keeps things on track. Whether it’s a monthly check-in or a quarterly deep dive, getting into a routine of assessing where your money’s going helps you stay accountable and responsive to any changes.

Keeping an eye on your spending habits is simpler than ever thanks to technology. Use apps or even a detailed spreadsheet to track where every dollar goes. You’ll quickly spot patterns and habits that might need tweaking.

Budget leaks are those sneaky expenses that catch you off guard. They might be that daily coffee run or subscriptions you forgot about. Identifying these can free up significant cash for your priorities.

Life happens, and your budget should flex with it. Adjusting your spending plan for unexpected events like a medical bill or a sudden car repair is crucial. Flexibility in your budget allows you to handle surprises without panic.

Fostering a Healthy Financial Mindset

Building financial discipline is like developing a muscle; it takes time and consistency. Sticking to your budget requires more than just numbers; it needs commitment and sometimes saying no to immediate pleasures for long-term gains.

Money stress isn’t uncommon, but managing it is crucial. Simple practices like mindfulness, meditation, or just talking with someone can keep your mind balanced. It’s all about keeping financial anxiety from taking the driver’s seat.

Continuous learning helps keep you updated on the best financial practices. Whether it’s reading books, taking courses, or even following finance blogs, educating yourself plays a huge part in smart money management.

Celebrate your wins, big or small. Recognizing budgeting successes can motivate you to keep pushing forward. Whether you paid off a debt or saved up for a trip, acknowledging these milestones is an important part of the journey.

Now that you’ve built a solid budgeting foundation, the next step is tackling debt. Check out these 10 proven strategies to climb out of debt fast and take control of your financial future!